tax lawyer vs cpa reddit

In Law and masters degree in tax law and accounting degree which one would be better to be working with taxes and advising clientscompanies. Honestly tax lawyer is an entirely different path from a cpa.

What Is The Crime Known As Tax Obstruction 7212

Learn what each one does and when you might call on them for help.

. Ea vs tax attorney cpa vs tax attorney reddit lawyer vs tax attorney tax attorney wichita ks tax attorney wilmington nc tax attorney walnut creek tax attorney what do they do tax attorney winston salem tax attorney washington dc tax attorney waco tx tax attorney washington state robert w wood tax attorney tax attorney youngstown ohio tax. It is title 26 of united states code. So if you really want to do something legal minded you can do so while still having a CPA but just keep in mind you will barely ever litigate only if you are in a strictly tax controversy practice at your accounting firm.

I just started out and Im currently thinking about my long-term career path and where I want to see myself in the future. On one hand an accountant is focused on ensuring that based on the information and documents received from the taxpayer that computations and calculations are accurate. Ad study the cpa program with the level of support you need to succeed.

Tax attorney vs cpa reddit. Hire a tax attorney if youre one of the unlucky 25 getting audited this year or if youre dealing with any other tax controversies. However I am curious on how easy it is to pivot from tax preparation and advising on the CPA side to.

I am currently in my last year of undergrad in accounting at a good business school WP. The biggest difference in terms of tax practice is that an attorney is often going to be much better at appearing in tax court and framing an argument. Perhaps summed up best by brad huntington a multimillionaire business strategist when trying to decide whether to consult with your attorney or your cpa ask yourself the following three questions.

Tax attorney vs cpa reddit. If you need someone to handle the numbers to tell you what you have. 7031 Koll Center Pkwy Pleasanton CA 94566.

Tax Attorney vs. A tax attorney who plans during college can easily become a CPA as well. There is a clear difference in the focus and skillset of an attorney vis-à-vis the focus and skillset of an attorney.

My group is a mix of 75 attorneys to 25 cpas. Im Brazilian and would like to work helping companies going abroad and doing their tax for them. Hire a tax attorney if.

I am debating between pursuing a law degree or obtaining a masters in tax and trying to get on at a big 4. A CPA does not have the same knowledge as a Tax Lawyer. Honestly tax lawyer is an entirely different path from a cpa.

Even with the loans. CPAs are for accounting issues Tax Lawyers are for legal issues. Using a tax attorney for help with certain tax.

I really like tax and am planning on getting my CPA. Whether you are looking to file your taxes correctly or deal with issues related to past filings we have the experience to help you get the best possible results. I think you need a tax lawyer not a CPA--and I think you need on here in the States as well as a lawyer based in the jurisdiction where the property is located.

The Difference Between a CPA and a Tax Lawyer. With all the related interpretations and cases. A tax attorney is a type of lawyer who specializes in tax law.

Thats a long 5 years filled with busy seasons and lots of. Students in tax at the graduate level going for an mtax are often sitting side by side with llm and JD students briefing the same cases. A Tax Lawyer has the same knowledge as a CPA.

Certified public accountants CPAs and tax attorneys are both uniquely qualified and trained professionals that can help you with taxes and financial. To set up a consultation call us today at 800 681-1295. Tax Attorney Vs Cpa Reddit - sean â Page 73 â GG ADV.

A Tax Lawyer has the same knowledge as a CPA. Here are seven options you have to pay the IRS when you owe taxes from an attorney and CPA who concentrates in tax planning and estate planning. The ceiling for cpa is much lower and compensation reflects that.

A tax attorney is a lawyer who knows how to review your tax decisions to see what the IRS allows. My group is a mix of 75 attorneys to 25 CPAs. CPA to Tax Lawyer.

I suppose the benefit of being a CPA and not attorney is that you graduate sooner and dont spend all that money on tuition. Have a link between Brazil Portugal and MacauHong Kong because we have same the same. News discussion policy and law relating to any tax - US.

Each plays a distinct role and theres a good rule of thumb for choosing one. A CPA or certified public accountant is someone who specializes in taxes and can manage the math involved with them. Honestly they are very very similar at the higher levels.

While both CPAs and tax attorneys can represent your best interests in communications with the IRS a tax attorney is generally the better choice if youre involved in trouble with tax authorities such as. It is title 26 of united states code. If your business faces legal tax issues you need to hire a tax attorney because they have a deeper understanding of the legalities in the US.

Thats a long 5. In the context of CPA vs tax attorney each role has its benefits and limitations. Tax attorneys and CPAs are two different but similar professionals who can help you with taxes and financial planning.

I have a very high GPA 394. The primary difference between the two is that while a CPA holds expertise in dealing with the financial implications of tax matters a tax attorney specializes in handling the legal aspects of taxation. The biggest difference in terms of tax practice is that an attorney is often going to be much better at appearing in tax court and framing an argument.

Tax Attorney Vs Cpa Reddit My Law Professor A Real Lawyer Doesn T Like Accountants So He S Teaching Us The Truth On Tax Law I Thought Yall Would Enjoy This R Accounting Well break down everything you need to know about paying taxe. We are fully licensed attorneys as well as fully licensed and accredited CPAs. Each plays a distinct role and theres a good rule of thumb for choosing one.

Tax attorneys usually do not prepare tax returns and farm the work out to a CPA for extra fees. A cpa at the big 4 will start out in the mid-50k range and maybe be at 100k after 5 years in a big metro. Both professionals command a good salary and excellent.

There are many things to learn to become an expert this is why we have. And International Federal. Tax attorneys specialize in the minutiae of the IRS tax code.

Choose a tax lawyer when receiving notices of debt. Im an attorney and I focus in taxation. Ended up working in a big four accounting firm as a tax attorney any way.

Reddits home for tax geeks and taxpayers. While a tax attorney is typically reserved for more specific and complex.

Top Rated Tax Resolution Firm Tax Help Polston Tax

Aiden Durham Allupinyobiz Twitter

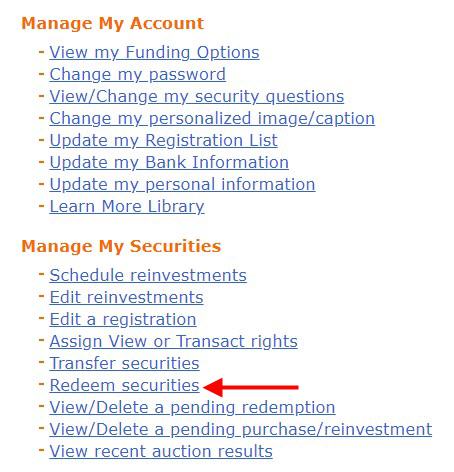

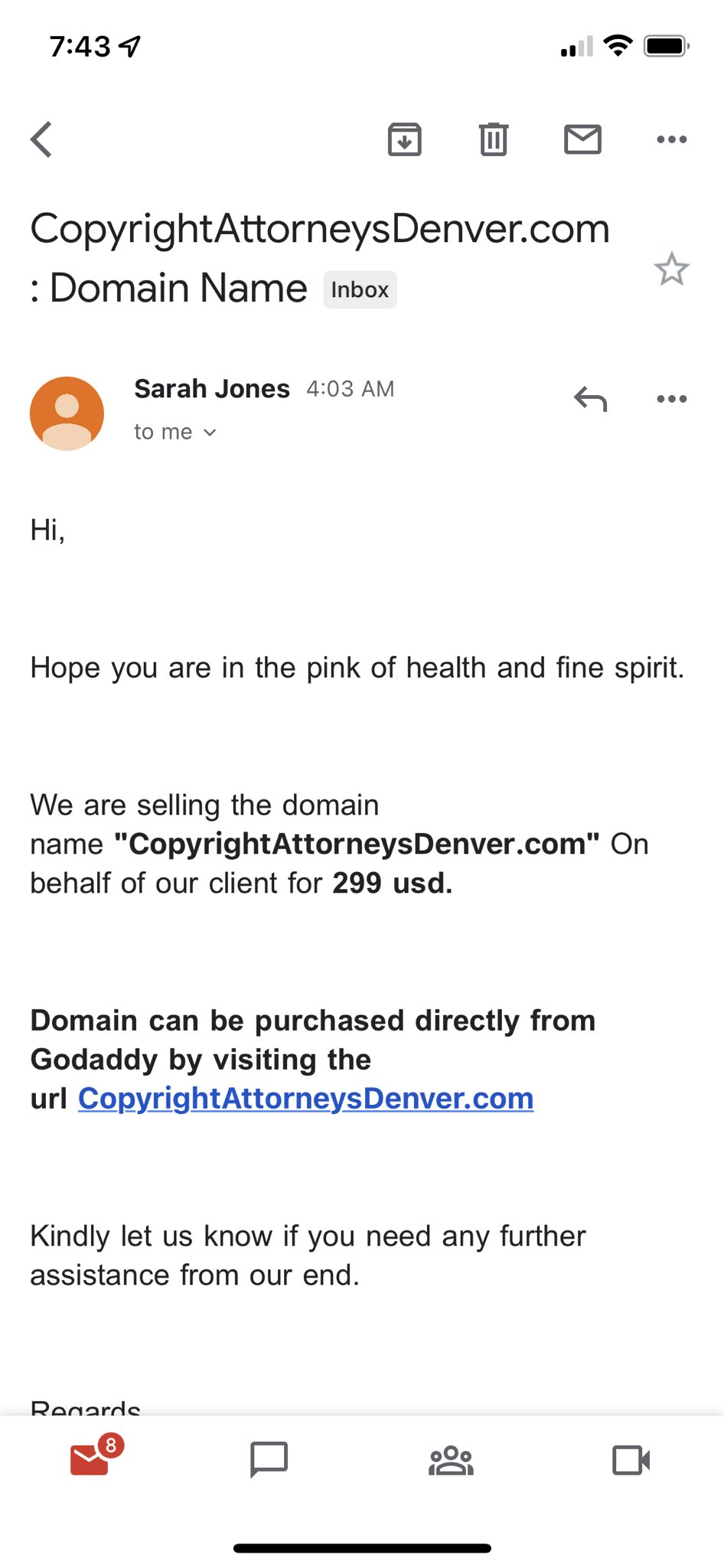

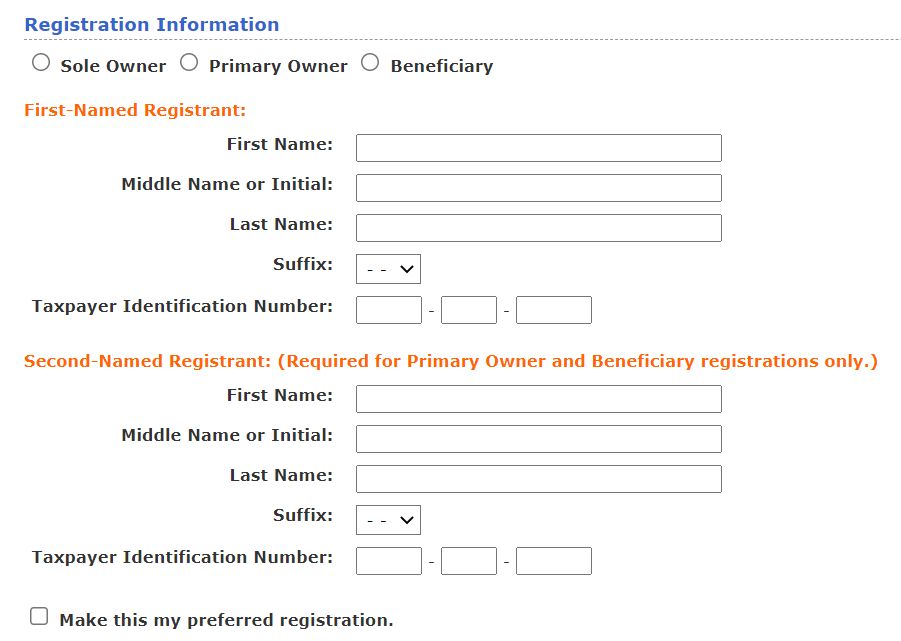

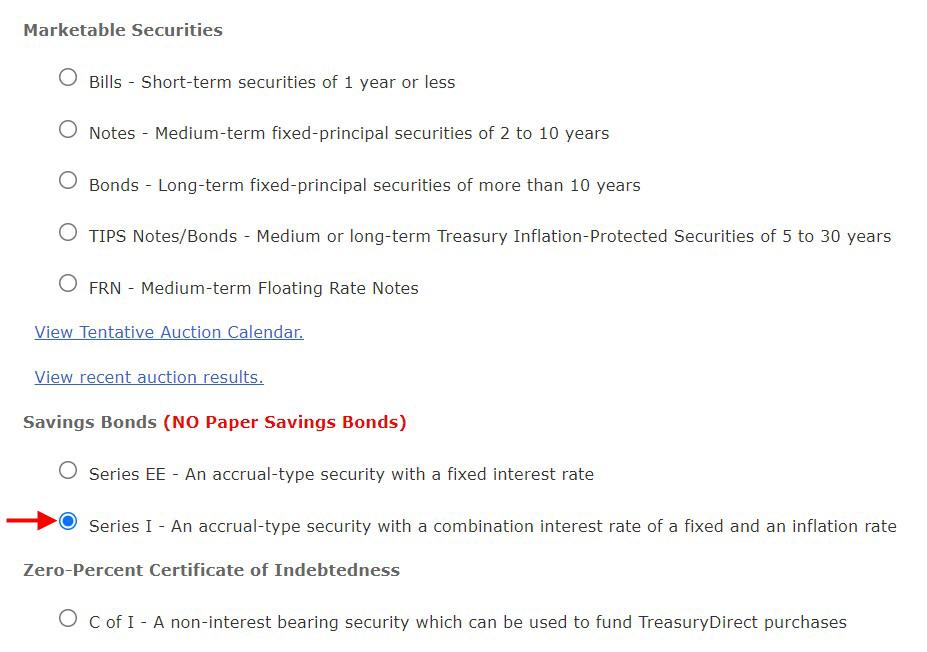

How To Buy I Bonds Series I Savings Bonds Soup To Nuts

Does The Statement You Can Always Do Finance With An Accounting Degree But You Can T Do Accounting With A Finance Degree Have Any Validity To It R Accounting

Cpa Taking The Stand In The Depp Heard Case We Ll See What He Has To Say This Man Does Not Depreciate Land R Accounting

If You Re Serious About The Law Think Long Term I Know Most Write It Off But Tax Is Generally More Secure Big Law Tax Ama R Lawschool

How To Buy I Bonds Series I Savings Bonds Soup To Nuts

My 1 Inheritance Check R Mildlyinteresting

I Owe My Employer 1500 For Their Payroll Deduction Error R Antiwork

How To Buy I Bonds Series I Savings Bonds Soup To Nuts

I Had To Do It Accounting Humor Accounting Finance Infographic

Do I Need An Accountant For A 1 Person S Corp R Smallbusiness

My 1 Inheritance Check R Mildlyinteresting

How To Buy I Bonds Series I Savings Bonds Soup To Nuts