sacramento county tax rate 2021

The last 025 goes toward county transportation funds. LOS ANGELES COUNTY TAX COLLECTOR KENNETH HAHN HALL OF ADMINISTRATION 225 NORTH HILL STREET ROOM 137 LOS ANGELES CA 90012.

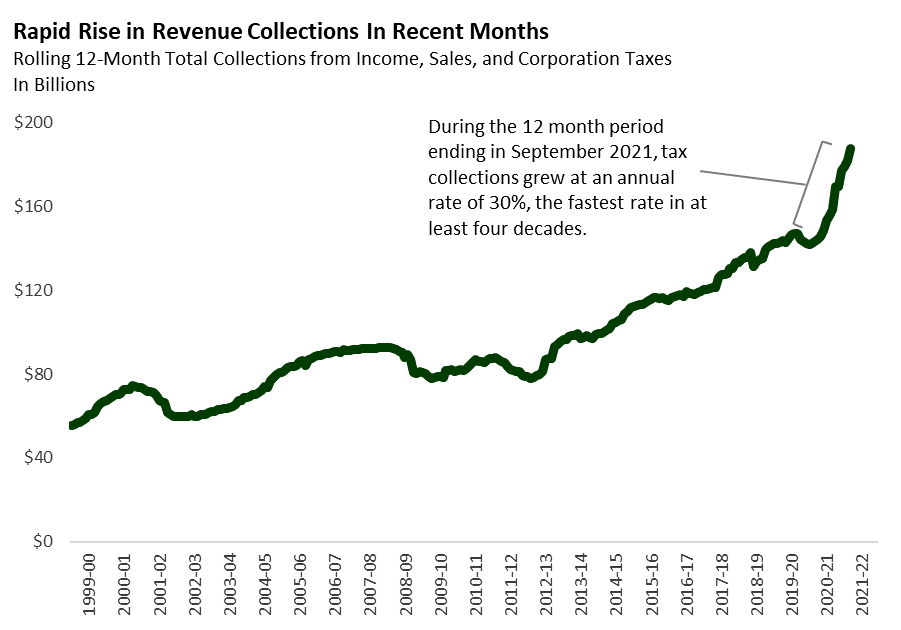

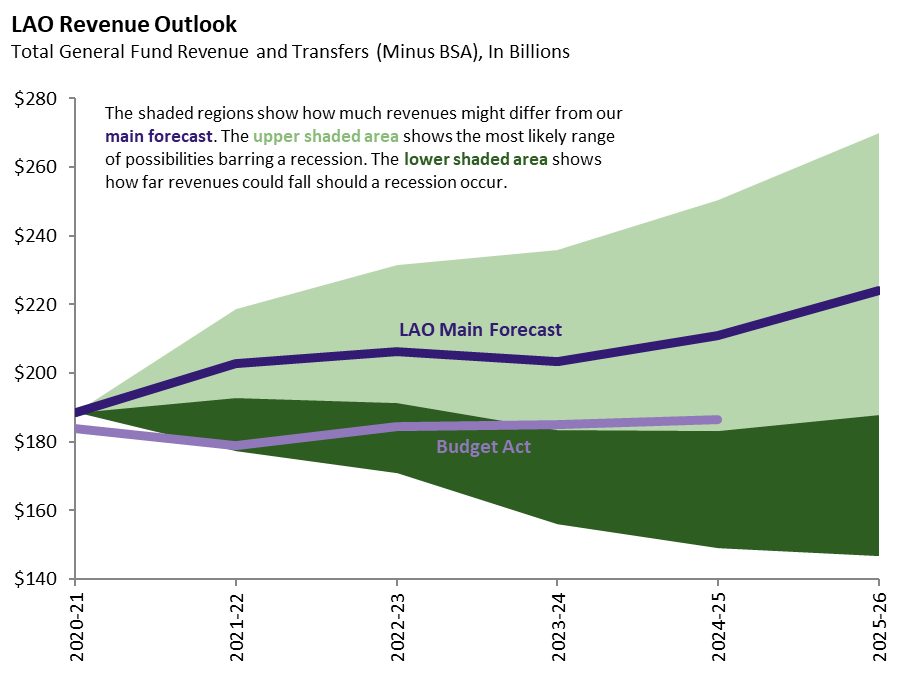

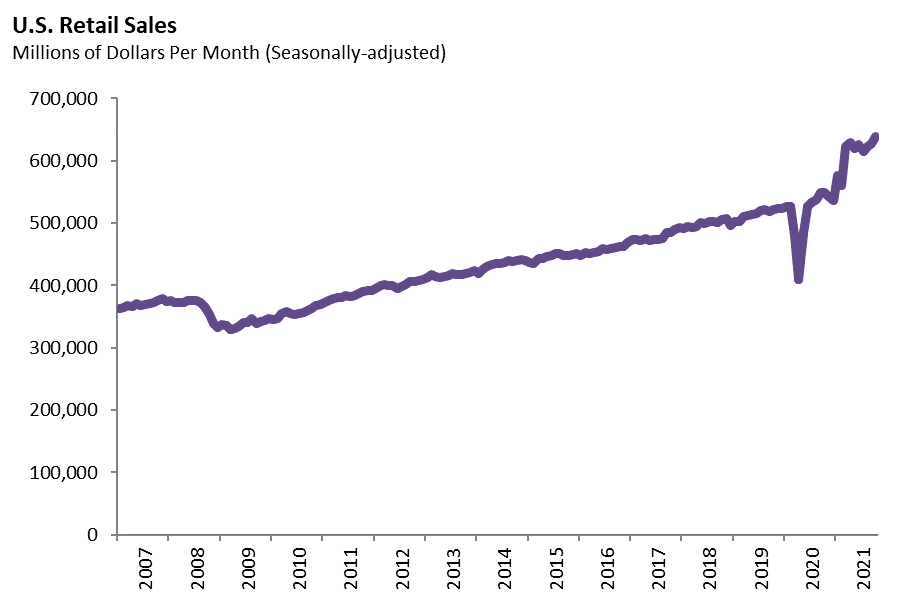

2022 23 Fiscal Outlook Revenue Estimates Econtax Blog

Equalized Assessed Valuation by Tax Rate Areas.

. That is nearly double the. Thursday July 01 2021. Our Responsibility - The Assessor is elected by the people of Sacramento County and is responsible for locating taxable property in the County assessing the value identifying the owner and publishing annual and supplemental assessment rolls.

2020 rates included for use while preparing your income tax deduction. Sacramento County collects on average 068 of a propertys assessed fair market value as property tax. The 125 breaks down into two different funds.

Click here for a larger sales tax map or here for a sales tax table. CBS News Sacramento. For questions unrelated to withholding or to download view and print California tax forms and publications see the information below.

Ftbcagov Phone 800-852-5711 from within the United States 916-845-6500 from outside the United States. The median property tax paid by homeowners in the Bay Areas Contra Costa County is 4941 per year. This rate includes any state county city and local sales taxes.

Our Mission - We provide equitable timely and accurate property tax assessments and information. City level tax rates in this county apply to assessed value which is equal to the sales price of recently purchased homes. Sacramento County has one of the highest median property taxes in the United States and is ranked 359th of the 3143 counties in order of.

UCI sweatshirts sold at Orange County Costco stores mistakenly printed as UC Urvine. Annual Financial Report Photo 2021 - E - Ulysses L. The latest sales tax rate for Sacramento CA.

Learn more About Us. Public Works Financing Authority Lease Revenue Bonds 2021 Series F Green Bonds Public Works Financing Authority Lease Revenue Bonds Series 2020 A LACMA Building for the Permanent Collection Project Green. The entire state must pay this tax and the money all goes to county andor city governments.

Pennsylvania has state sales tax of 6 and allows local governments to collect a local option sales tax of up to 2There are a total of 68 local tax jurisdictions across the state collecting an average local tax of 0166. County or city operational funds gets 1. Internet and Telephone Assistance Website.

Connect with Sacramento County Gain Access to SacCounty News. Latest breaking news from CBS Sacramento. Franchise Tax Board PO Box 942867 Sacramento CA 94267-0651.

Free 247 News. The remaining 125 of the California sales tax is a county tax. The property tax rate in the county is 078.

The median property tax in Sacramento County California is 2204 per year for a home worth the median value of 324200. Combined with the state sales tax the highest sales tax rate in Pennsylvania is 8 in the cities. Sign Up.

What Are California S Income Tax Brackets Rjs Law Tax Attorney

Sales Tax Rates Finance Business

Secured Property Taxes Treasurer Tax Collector

Secured Property Taxes Treasurer Tax Collector

California S Tax Revenue System Isn T Fair For All California Budget And Policy Center

Cryptocurrency Taxes What To Know For 2021 Money

California S Tax Revenue System Isn T Fair For All California Budget And Policy Center

2022 23 Fiscal Outlook Revenue Estimates Econtax Blog

2022 23 Fiscal Outlook Revenue Estimates Econtax Blog

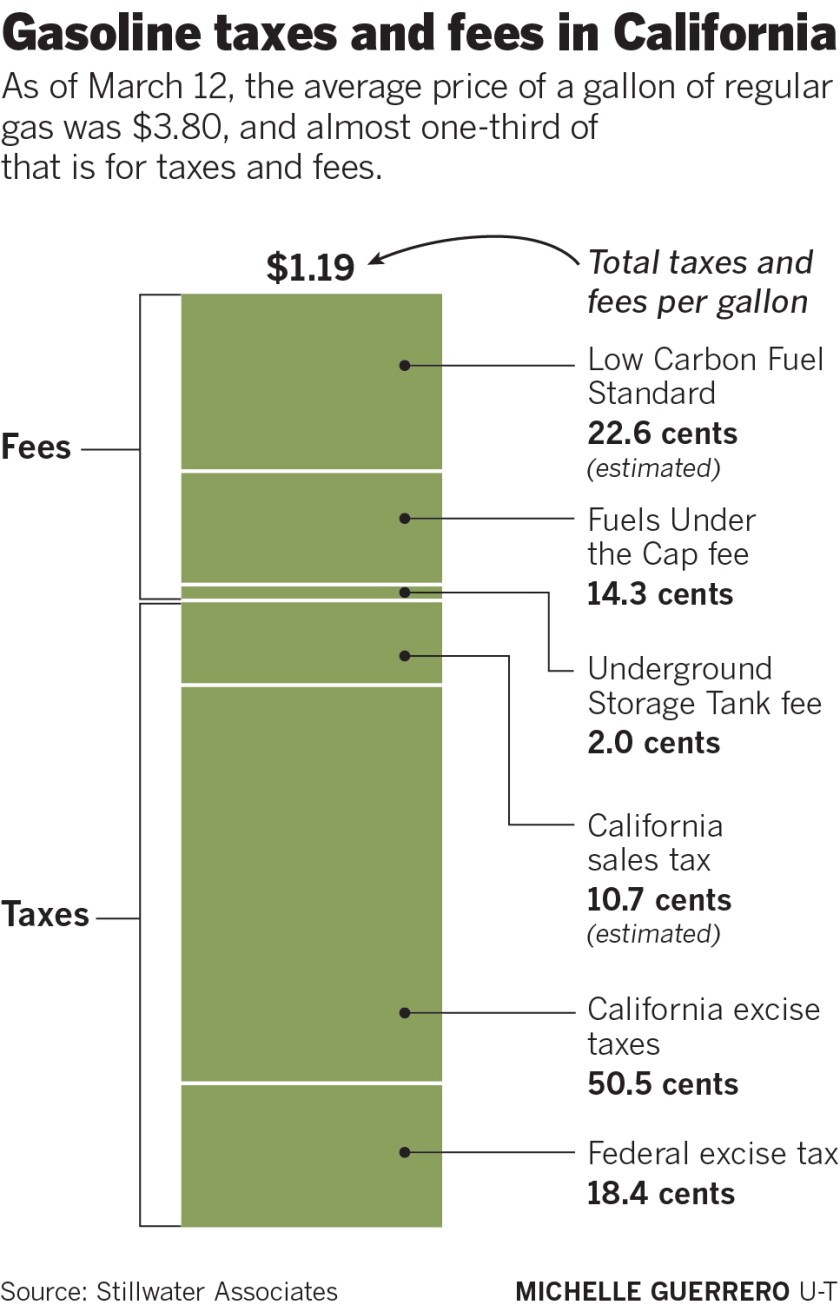

How Much Are You Paying In Taxes And Fees For Gasoline In California The San Diego Union Tribune

Income Tax Return Filing Deadline What Time Are Taxes Due In 2022 Marca

California S Tax Revenue System Isn T Fair For All California Budget And Policy Center

Missouri Income Tax Rate And Brackets H R Block

Property Taxes Department Of Tax And Collections County Of Santa Clara

New Jersey Nj Tax Rate H R Block

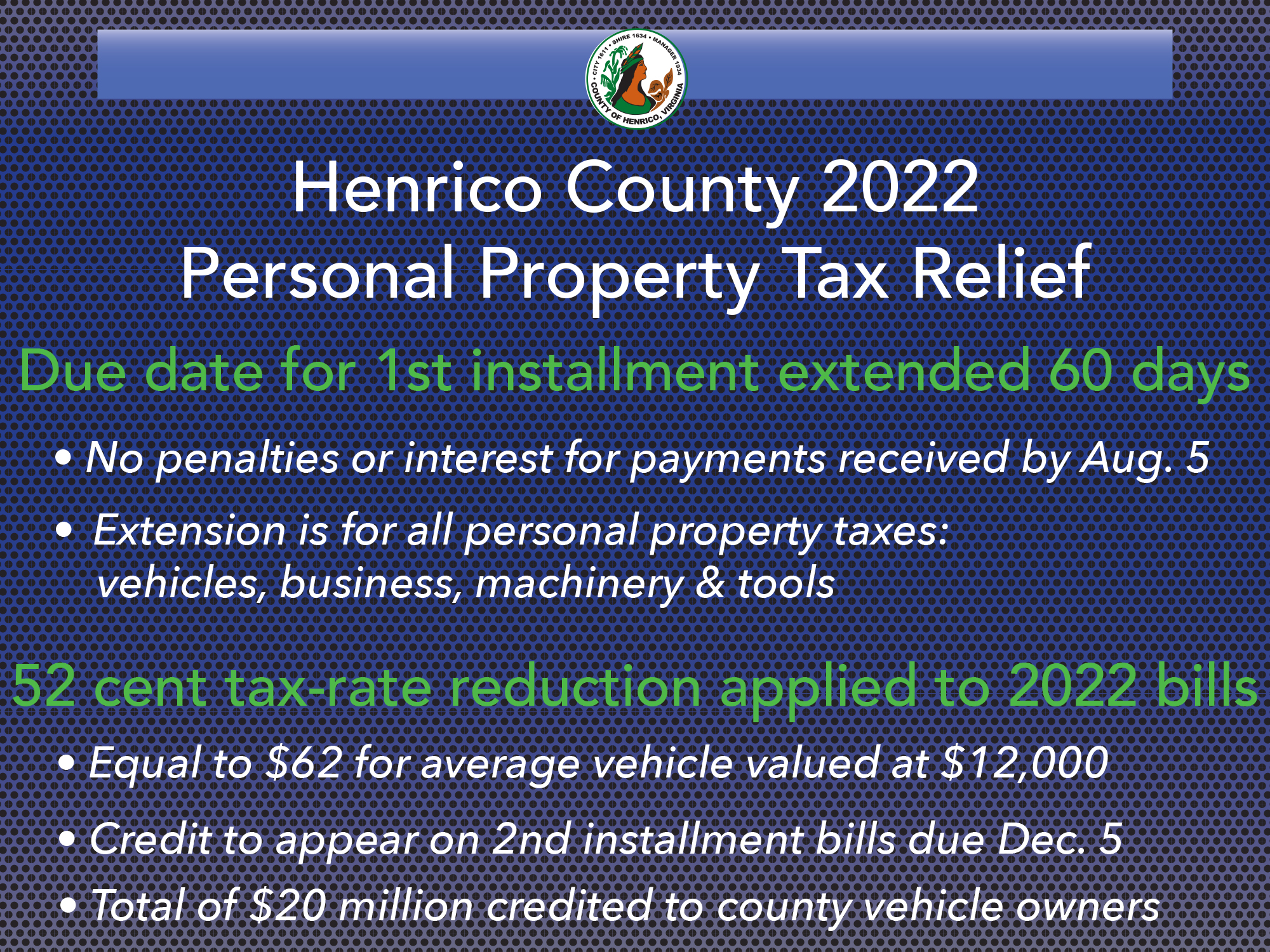

Henrico Proposes Personal Property Tax Relief To Offset Rising Vehicle Values Henrico County Virginia